In recent days, Sunrise Duty Free (Shanghai) (“Sunrise”) was blocked by its board of directors from participating in the duty-free tender for Shanghai’s two major airports. The veto came from four directors appointed by China Duty Free Group (CDFG).

This decision means that when the current contracts expire, Sunrise will no longer be eligible to continue operating. The exclusive era of Sunrise at Shanghai’s airports is now in its final countdown.

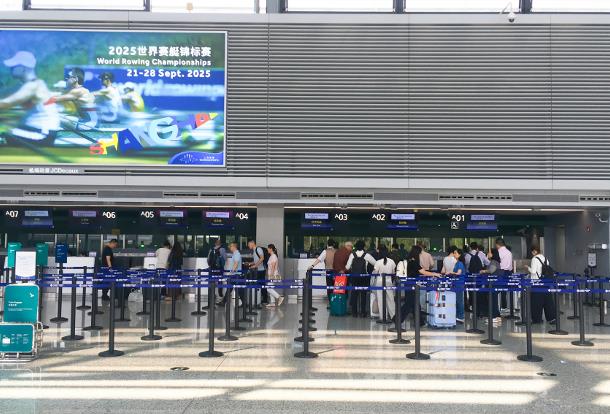

Sunrise first entered Pudong Airport in 1999, becoming the first foreign-invested duty-free operator to enter a Chinese airport. It later expanded to Hongqiao and Beijing Capital Airport, forming a rare Beijing–Shanghai dual-hub presence across three major gateways. For years, it served as the industry’s gatekeeper of premium channels.

Over the past two years, the pressure on CDFG has become increasingly visible:

• In 2024, revenue fell 16.38%, and net profit dropped 36.44%, marking the steepest decline in recent years.

• In the first three quarters of 2025, revenue continued to decrease by 7.34% year-on-year, while net profit fell by more than 22%.

Meanwhile, the industry itself is recovering:

• In 2024, the global duty-free market reached USD 74.1 billion—up 3% year-on-year and returning to 85.8% of pre-pandemic levels.

• China saw inbound tourist volume grow 60.8% year-on-year, with spending surging 77.8%.

As the foundations of capital and regulation shift, the logic on the consumer side is being reconstructed in parallel:

Consumption is moving from material to meaning-driven. Consumers are no longer motivated solely by price advantages, but increasingly by scarcity, cultural identity, and lifestyle resonance. The appeal of duty-free shopping is shifting from “discounts” to “experience + emotional value.”

As the industry shifts from price-centric to experience-centric, companies like Sunrise Shanghai—whose success over the past two decades was built on channel dominance—must confront a new-cycle challenge: to re-understand the consumer.