“Asia-Pacific’s aviation market is growing at over 8%, outpacing the global average.”

“Airlines worldwide earn just $7.2 in net profit per passenger — about the cost of a cup of coffee.”

“China’s airport network is expanding rapidly, but overcapacity has become the biggest concern.”

At the 2025 TravelDaily Conference, Xin Jiang, Regional Director, Financial and Distribution Services, North Asia, IATA, provided a dual global and China-focused outlook on the aviation market. She shared the latest industry trends and offered forward-looking insights on future route networks and passenger demand patterns.

Jiang noted that while the global airline industry has rebounded strongly from the pandemic, profitability remains at historically low levels. Meanwhile, in China, rapid expansion continues, but structural challenges such as overcapacity and weak yields loom large.

GDP Recovery, Oil Prices, and Inflation Provide Tailwinds

Jiang began by reviewing macroeconomic drivers. She emphasized that aviation is a highly cyclical industry, heavily influenced by external factors.

“We are seeing steady recovery after the pandemic. Global GDP is expected to grow around 5.3% in 2025. At the same time, fuel accounts for 20–25% of airline operating costs, and the recent decline in oil prices is a significant boost for the industry,” she said.

She added that stabilizing inflation is another positive for demand, while cautioning that uncertainties such as tariffs and trade disputes will continue to weigh on the sector.

Aircraft Deliveries Delayed, Fleet Aging Slows Efficiency

Among internal challenges, capacity constraints are the most pressing.

“Before the pandemic, the average aircraft delivery lead time was four to five years. Now it has stretched to over six years,” Jiang explained. “As of 2024, there are more than 17,000 undelivered aircraft orders worldwide. A new order placed in 2025 would not be fulfilled until 2035.”

This delay has pushed up fleet ages. Prior to the pandemic, the average age of China’s fleet was about six years; today it has surpassed eight. Fewer new aircraft mean fuel efficiency gains have slowed, adding to carbon emission pressures. “China once had the world’s youngest fleet — that advantage is now slipping away,” she said.

Asia-Pacific Leads, Load Factors Hit Record Highs

On the demand side, global aviation activity has returned to pre-pandemic levels. Jiang stressed that trendlines are more important than minor differences in data points.

“Using January 2020 as a baseline, both passenger and cargo traffic have fully recovered,” she said.

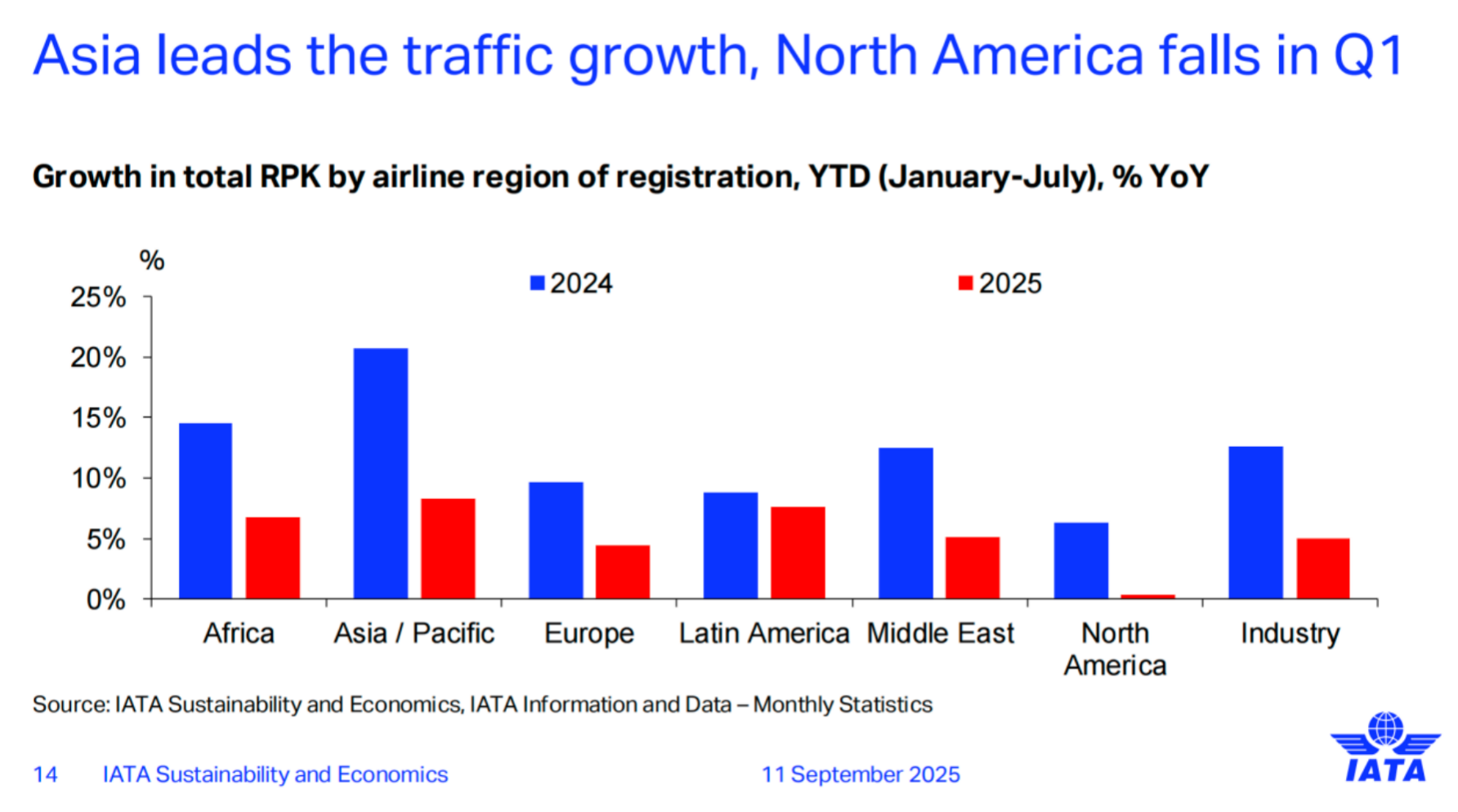

The standout is Asia-Pacific, with growth surpassing 8% in 2025 compared to the global average of around 5%.

Strong demand combined with constrained capacity has pushed global load factors to nearly 85% — a historic high. Growth in international travel is particularly strong within Asia, and between Asia, Europe, North America, and Africa.

Profitability Still Thin: “The Price of a Coffee”

Despite robust recovery, profitability remains fragile.

“We expect global airline revenues to exceed $979 billion in 2025, with operating profits of $66 billion. Net profit will be just $36 billion, a margin of only 3.7%,” Jiang noted.

This translates into a net profit of just $7.2 per passenger — what IATA calls the “Starbucks Coffee Index.” “In other words, every passenger carried brings airlines a profit no greater than a cup of coffee — only 20 cents more than last year,” she said.

Asia-Pacific’s situation is even tougher, with net profit per passenger at just $2.6 — barely above Africa, and far below Europe and North America. “We are leading in volume, but lagging in profitability,” Jiang admitted.

China Market: Expansion Accelerates, Overcapacity Looms

Turning to China, Jiang highlighted both opportunities and risks. By 2035, the country could have as many as 400 airports, with visa facilitation and inbound tourism driving further growth.

But challenges are mounting. Overcapacity remains the biggest concern. Over the past 25 years, China’s fleet has grown at an average annual rate of 11%, compared to the global average of 2%. Yet aircraft utilization remains below pre-pandemic levels, with average daily flying hours under eight — a direct drag on profitability.

Geopolitical and trade policy uncertainties are also weighing on the market. “The recent suspension of duty-free exemptions for small parcels has hit China hard, since about 45% of such shipments originate here,” Jiang said.

She also noted competition from high-speed rail, adding that how China manages its capacity expansion while improving yields will be the defining challenge of the next decade.

Premium Travelers and Channel Shifts: Direct Sales Surpass Distribution

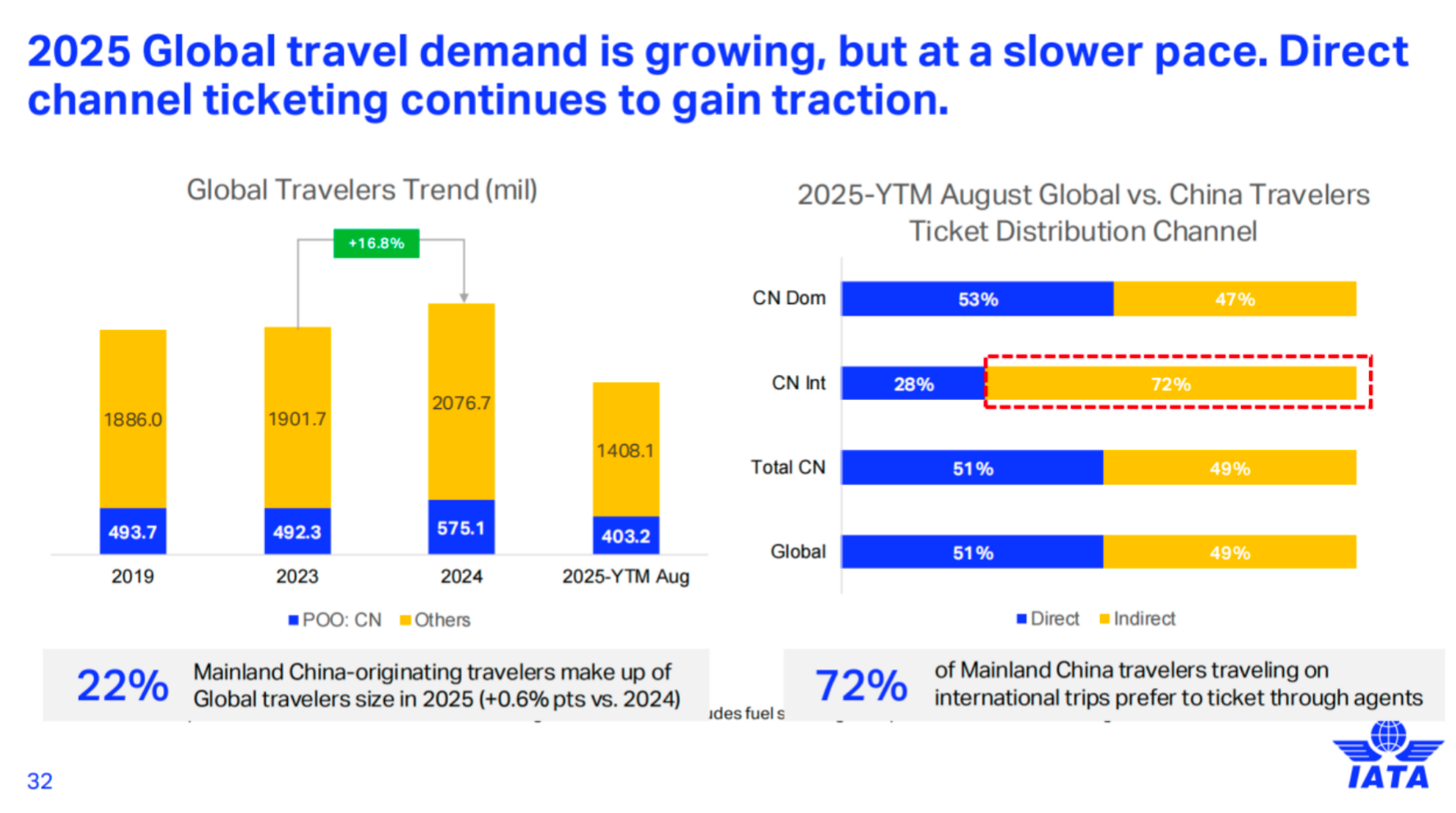

IATA data shows clear shifts in traveler behavior and sales channels.

“Passengers originating from China account for around 22% of the global total, with premium travelers making up about 15%. Notably, 51% of global premium travelers now purchase through direct sales channels — a sharp increase from pre-pandemic levels,” Jiang reported.

In China, about 47% of domestic sales come via distribution channels, while for international markets the figure rises to 72%. By contrast, India’s domestic market relies on distribution for 79%, while in the U.S. the share is only 31–35% across both domestic and international.

Average ticket prices show another shift: for the first time, direct sales have overtaken distribution, particularly in business and first class. “This may reflect Gen Z travelers’ comfort with digital channels and their greater willingness to pay for comfort,” Jiang suggested.

Data Tools and Ongoing Insights

Jiang concluded by introducing IATA’s Direct Data Services (DDS) database, which aggregates daily direct and indirect sales data from over 116 airlines worldwide. It is widely used for agency management, revenue optimization, and network planning.

“All of these insights are updated in real time on our website and WeChat account. We welcome further discussions after the session,” she said.

Quality Challenges Behind Recovery

Jiang emphasized that while aviation has entered a phase of “volume recovery,” profitability remains razor-thin. The future hinges on improving efficiency and yield quality.

Asia-Pacific and China will continue to drive demand growth, but avoiding overcapacity and boosting profitability are critical for long-term sustainability.

“Aviation is, and always has been, a tough business,” Jiang concluded. “Recovery is encouraging, but to go further, the industry must focus on structural improvements, collaboration, and innovation.”