Chinese hotel chain Huazhu registered an 11.4% rise in net revenue in 2019, but the company's same-hotel data on RevPAR, ADR and Occupancy all saw declines. Soft brands have dragged down the overall comparable performance, for same-hotel RevPAR and ADR will do a much better job if soft brand performance were excluded.

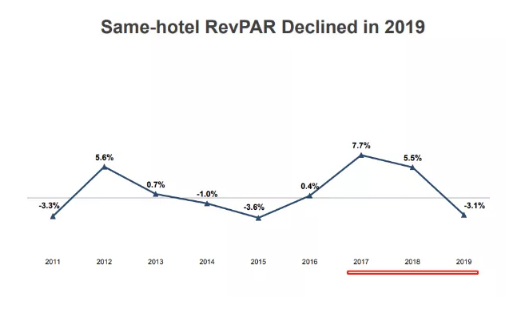

Huazhu's same-hotel RevPAR growth has seen ups and downs for the past few years, but during the latest three years from 2017 to 2019, the figure has been going down continuously, from +7.7% to +5.5% and -3.1%.

Huazhu's same-hotel RevPAR growth has seen ups and downs for the past few years, but during the latest three years from 2017 to 2019, the figure has been going down continuously, from +7.7% to +5.5% and -3.1%.

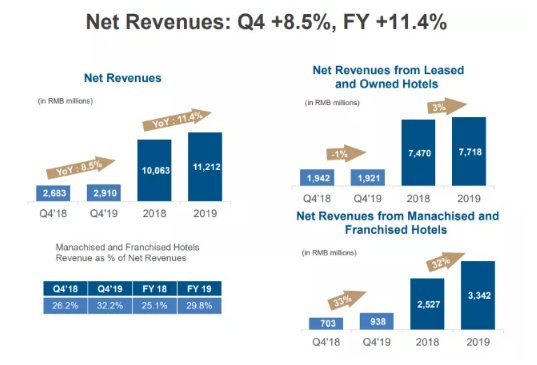

The company's leased and owned hotels were slowing down last year while the manachised and franchised properties were delivering better growth. But it is still worth noticing that the manchised and franchised hotels made a much smaller contribution to Huazhu's total revenue in 2019, representing only 29.8% share of the company's annual net revenue.

The company's leased and owned hotels were slowing down last year while the manachised and franchised properties were delivering better growth. But it is still worth noticing that the manchised and franchised hotels made a much smaller contribution to Huazhu's total revenue in 2019, representing only 29.8% share of the company's annual net revenue.

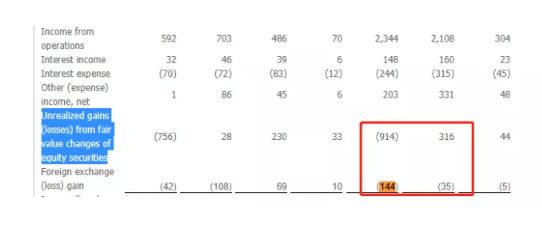

Net income attributable to Huazhu Group for the full year of 2019 increased 147.1% to RMB1.8 billion (USD 254 million), and non-operating incomes like gains from equity investments contribute significantly in the company's annual profit.

Unrealized losses from fair value changes of equity securities for 2018 were RMB 914 million while gains for 2019 were RMB 316 million. This means the company's income from equity investments or holdings last year was around RMB 1.2 billion, which represents a significant part of the company's annual profit figure.