ChinaTravelNews, Ritesh Gupta – Chinese short-stay rental specialist Tujia is gearing up for a big leap in the next 18 months. The company is confident of taking its annual gross merchandise value (GMV) to a level, which it believes would chart a new chapter in its growth trajectory.

“Our GMV target is 15-20 billion yuan (RMB) by 2019. It was 2.3 billion RMB last year,” Tujia’s CFO Warren Wang told ChinaTravelNews.com in an interview.

Wang added, “We believe it’s a huge market with huge potential. Right now we have around 1.2 million houses available on our platform, available for rent. The size of the market, as per our estimate, can be over 10 million, going up to 15 million houses in China. We currently have less than 10% representation of the entire size of the market on Tujia's platform.”

GMV over the years has emerged as a measure of the total marketplace scale created by a company and also a foundation for assessing valuation in capital raising. Even as doubts do get raised over GMV being an accurate representation of an e-commerce company’s performance, Wang believes that the category has now at a stage where more purposeful expansion can be expected. Wang does foresee this industry progressing as far as working on a superlative product and accommodation option in the travel sector is concerned.

Tujia CFO Warren Wang

He said, “The industry in China is at its infant stage. We started out in 2011-12, but it's been only in the last couple of years or so, travellers have got well-versed with the sharing economy and home stay concept. One can witness significant increase in the number of listings or people here trying out these properties instead of staying in a hotel. As for the way companies in the whole sector are trying to fight out, yes a lot of money is being "burnt" at this stage. From our perspective, we see in the coming two years - 2019 and 2020 - things would change. If we can expand our GMV and control the cost and expenditure for operations, we can start to make decent profit from our operations. That would be a signal to the industry that money (profit) can be earned. For this, one will have to provide value to all the stakeholders in the industry - home owners, travellers, OTAs etc.”

Being ahead of Airbnb

Tujia’s battle with Airbnb is being followed closely.

From being possibly involved in a strategic alliance, the two companies are now talking of scaling operations separately. As indicated by Airbnb during a recent interview with ChinaTravelNews.com, the company has chosen to stick to its core strengths, including capitalizing on the network effect and Airbnb’s brand prowess. This is also exemplified by Airbnb’s decision to run a full-fledged operations on its own under the leadership of new president, Tao Peng.

“We acknowledge that Airbnb is the leader in this industry globally with over 5 million homes all over the world. In China, we are number one. We are much bigger than them,” asserted Wang.

He added, “We have apartments, independent houses…including properties in the rural areas, too. These properties have a certain character. There are houses on the trees, valley, on the boat etc. That's how we define uniqueness of our houses - in terms of location, the structure etc. In China, more than 80% of these houses are apartments. At the end of 2019, our target is to have 2 million houses.” Airbnb now has around 250,000 properties here.

Wang believes there are currently areas where Tujia has clear edge over others, including Airbnb. And there is also scope for improvement, an area such as product design in which Tujia can learn from Airbnb, acknowledged Wang.

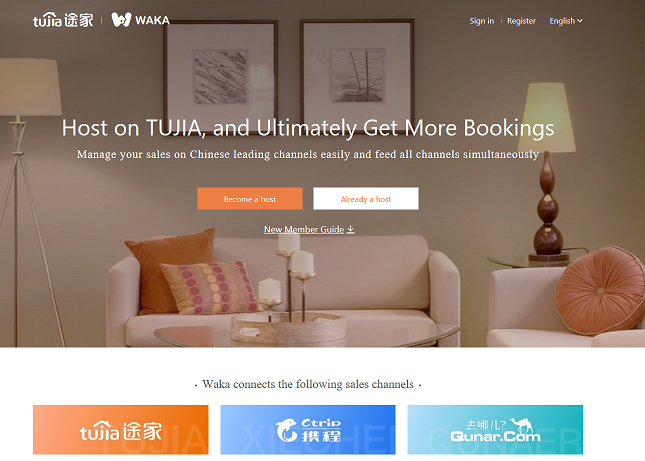

A major advantage, according to Wang, is reach. “In addition to the maximum number of listings in this category, we have presence via both direct and indirect channels. The list includes our app, Ctrip, Qunar, eLong, Mayi etc. Our association with Ctrip (the OTA being a shareholder/ strategic investor of Tujia) offers an advantage to us. Legally we own the entrance button for home stay in the Ctrip app.”

He add, “Ctrip, being the biggest travel app here in China, offers access to its set of travellers to us - could be business or leisure ones - booking everything from Ctrip. This includes flights, hotels, bus, train tickets etc. This cooperation brings to us most valuable (travel-related) traffic to us, even from outside China. We are confident of sustaining our leadership in conjunction with Ctrip. They don't set a short-term target for Tujia. They let us be the number one player in this industry. If a house/ apartment owner opt to list their property directly on Ctrip, it is possible. Otherwise, other than Tujia, there is no other OTA that can list a house for rental on Ctrip.com,” he said.

The Chinese company believes in reaching out to third party sites and ecosystems for traffic.

Airbnb is not reliant on OTAs for distribution. The company is confident about the strength of its brand in China. Most of its traffic and customers aren’t paid for, according to Airbnb.

However, Wang added, “It is vital to source traffic from as many source as possible - could be WeChat, their mini-program, one's own app, Ctrip...it is definitely a key factor in acquisition. This aspect related to reach needs to be addressed to be a winner in this industry.” He also acknowledged that already competition is on the rise, for instance, Meituan, has emerged as competitor for Tujia in the short-term rental category. "Meituan has a lot of traffic and have a similar offering (Hazelnut) as ours. We see them as a major player and as a competitor to Tujia," said Wang. Chinese home-sharing unicorn Xiaozhu.com has secured nearly $300 million in its latest financing round.

"Fliggy is more like a platform, like a Taobao focusing only in the travel industry. We can access their traffic. Any company can open a store on Fliggy. We have a store, too. Traffic from third party sites that converts is close 10% of our total bookings," said Wang.

One of the highlights of Airbnb’s operations has been its product development. The company has now recruited over 100 executives only for its product – including designers, engineers, product managers etc. – out of a total of 200 or so executives in China. Airbnb has worked on a new content feature, titled Stories, for Chinese users.

“Airbnb is quite strong in this sector (product design and UX). Their product is more attractive than any of the other player in this industry at this juncture. However, we are enhancing our product (interface, functionalities etc.), we intend to redesign the colour, layout etc. of our app. We are expanding our team to deliver a sharper product. We are learning from Airbnb, too,” mentioned Wang.

It is also pointed out that owing to the lack of prescribed regulations in general for this industry and local companies’ online + offline presence gives them edge over a foreign players.

As for keeping a vigil on the sort of properties that are being listed, the sector is taking significant initiatives. Airbnb has chosen to physically visit listings and inspect them against a set of criteria to verify quality. Also, the company introduced its education program leveraging online and offline efforts to engage with hosts. Recently, Airbnb talked about how amenities impact the travel plans of the Chinese people.

Wang, too, assured about quality of the properties listed on Tujia. “We have in-house teams as well as third party specialists for on-site inspection - take photographs, assess safety parameters etc. There are local teams that work with house owners, looking at aspects like managing the customer and how to operate houses on the platform. Only high quality houses can be listed,” he said.

Wang pointed out that technology-wise the company had made progress. For instance, the company has worked on its back-end stock management and has been working on ways to allow hosts gain access to real-time reservations, availability and pricing data. Tujia’s app enables hosts to post listings, check and manage room status on platforms.

Also, the team has been looking at expansion within Asia, and accordingly refining their overseas booking platform, which is integrated with iCal stock management tool.

Tujia is already looking at expansion in 11 countries and areas in this region, including Hong Kong, South Korea, Taiwan, Japan, Malaysia, Singapore etc.