Have you noticed that you now spend far less time searching and comparing when booking flights or hotels?

In the past, you would search, compare prices, read reviews and choose room types before making a decision. Today, a much more common journey is: you see a piece of content, skim a few comments and place an order. Some travelers even start by asking AI directly: “I have three days in Chengdu. Plan my trip for me.”

For consumers, this is a clear experience upgrade; for the industry, it signals a structural shift in who actually controls travel decisions.

One of the most visible consequences of this shift is ongoing layoffs across major platforms. Despite the continued recovery in global travel demand, large OTAs such as Expedia and Traveloka have continued to streamline their organizations.

This raises a counter-intuitive question:

If more people are traveling, why do platforms need fewer distribution and operations staff?

The recent HBX Group MarketHub Asia event in Bali offers a useful observation point — not from the consumer side, but from the B2B distribution layer.

HBX Group (owner of Hotelbeds) sits squarely in the middle of the travel value chain. On one side are hotel inventory and pricing rules; on the other are multiple distribution channels and sellers. Its systems process around 7.8 billion search requests every day.

HBX Group does not need to tell stories to travelers. It needs to answer a single operational question:

Which products, at what prices, and under what rules can be sold by systems.

Because B2B distribution connects supply and channels, it is also the first layer to feel the impact when decision-making shifts from people to algorithms.

The real change is not AI — it is decision control

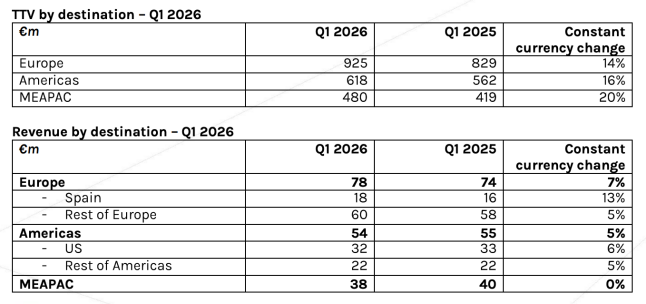

According to HBX Group’s latest results for the first quarter of fiscal year 2026, total transaction value (TTV) rose 16% year-on-year to €2.023 billion. Revenue, however, grew only 5%, and the overall take rate fell to approximately 8.4%, down about 0.9 percentage points from a year earlier.

In short, transaction volume is growing significantly faster than the platform’s monetization per transaction.

At the same time, the MEAPAC region (Middle East, Africa and Asia-Pacific) has become HBX’s fastest-growing market, with quarterly TTV growth of 20%. It is also the region with the lowest long-term take rate among HBX Group’s three operating regions.

This creates a clear strategic constraint. Future growth can no longer rely primarily on channel expansion or pricing leverage. It must come from higher transaction efficiency — including more accurate demand forecasting, more flexible dynamic pricing and more efficient supply allocation.

Under this pressure, the role of AI is being fundamentally redefined. AI is no longer viewed only as an internal productivity tool. It is increasingly positioned as a transaction decision engine that spans pricing, distribution, matching and fulfilment. These capabilities are being productized and gradually delivered to hotels and partners to support real-time pricing, demand prediction and inventory optimization.

Put simply, both growth potential and competitive pressure sit in Asia-Pacific — and AI investment is directly aimed at improving pricing power and transaction efficiency.

What is really changing, however, is not how “smart” AI has become. It is where decisions are made.

In the past, decision power sat with users. Travelers searched, compared and selected, while platforms mainly displayed inventory.

Today, decision power is shifting into systems. Filtering, ranking and itinerary construction are completed in the background before the user ever sees the options.

Search, comparison and trip planning — once handled by people — are now increasingly executed by systems. Users save time, but the industry loses the pricing leverage of the page-based distribution era.

The industry’s focus is therefore moving away from traffic entry points and toward one central capability: who can actually organize and execute a transaction through systems.

Many of this next-generation distribution models discussed globally are already everyday practice in China.

On platforms such as Xiaohongshu and Douyin, the consumer journey has largely moved away from the classic path of search, comparison and booking. Discovery, trust building and conversion now happen within the same content environment. Algorithms play the most decisive role by determining which options users are exposed to in the first place.

For most users, the real decision space exists only after algorithmic filtering. They are not choosing from the full market, but from a narrow candidate set created by the system.

China’s super-app ecosystem has effectively become an early prototype of this distribution logic. Users care far less about whether the transaction is fulfilled by an OTA, a brand website or a third-party platform. What matters is speed and convenience.

As generative AI and personal assistants enter mainstream consumer scenarios, algorithms are moving beyond being information filters and becoming decision orchestrators. They increasingly handle destination selection, itinerary construction and product matching — and, with user authorization, even complete purchases directly.

Choice is shifting from selecting among options generated by algorithms to having decisions executed by algorithms.

This is why the idea that “the future travel decision-maker may not be you” is no longer theoretical.

Technology is reshaping distribution — and raising the survival bar for suppliers

Under this new set of rules, competition in travel is fundamentally shifting.

In the past, companies competed for visibility on platforms or fought price wars with peers. Now the core competition is far more basic:

Can your products be called by algorithms instantly and reliably?

In a distribution system centered on intelligent agents, control moves away from traffic channels and toward data structures. If previously listing inventory and buying traffic were enough to generate bookings, today the real entry requirement is the level of product structuring.

When travelers hand trip planning to AI assistants, suppliers whose pricing rules, inventory status, cancellation policies or even room-type labels cannot be parsed reliably by machines effectively disappear from the algorithmic marketplace — no matter how popular they may be on social media.

This transparent and unforgiving machine screening is rapidly tightening the entry boundary for supply.

More importantly, AI is not merely changing how distribution works. It is redefining pricing power and fulfilment standards across the industry.

As the next buyer shifts from human to system, hotels and suppliers are judged on a set of very concrete capabilities: whether entitlements can be validated automatically, whether cancellation rules can be interpreted in real time, and whether product labels support automated itinerary assembly.

These technical details now determine whether a product remains inside the executable transaction pool.

As algorithmic purchasing becomes mainstream, competition for hotel groups, destination suppliers, DMCs and B2B platforms is shifting away from marketing strength toward product structure and data capability.

When the algorithm becomes the ultimate buyer, the question is no longer about your brand, but your readability.

If it cannot enter the transaction workflow, traffic — no matter how large — is only noise.