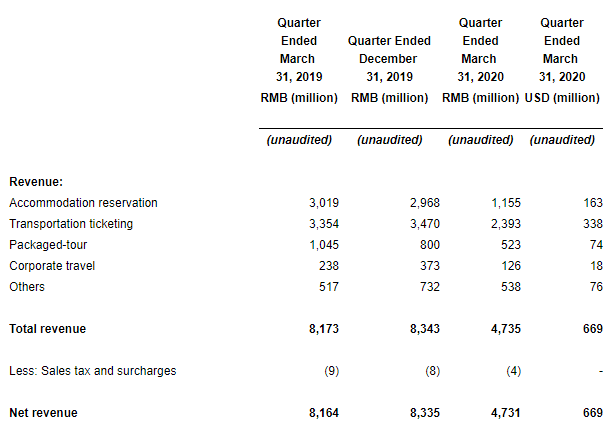

Chinese online travel powerhouse Trip.com Group said its first-quarter results have been significantly and negatively impacted by the COVID-19 pandemic. Net revenue plummeted 42% to RMB 4.7 billion (USD 669 million) during the quarter.

The company adopted cost control measures to reflect a significant slowdown in consumer demand. Total cost and expenses declined by 14% year-over-year in the first quarter. Excluding bad debt provisions, total cost and expenses declined by 31%.

Loss from operations for the first quarter was RMB 1.5 billion (USD 211 million). Net loss for the quarter was RMB 5,338 million (USD 752 million).

Accommodation revenue decreased 62% to RMB 1.2 billion (USD 163 million), while transportation revenue was RMB 2.4 billion (USD 338 million), down by 29%.

Packaged-tour revenue for the first quarter was RMB 523 million (USD 74 million), representing a 50% decrease from the same period in 2019. Corporate travel revenue for the quarter was RMB 126 million (USD 18 million), representing a 47% decrease.

"The COVID-19 pandemic has brought significant challenges to the global travel industry. However, it is encouraging that by now, we have seen stabilization or recovery of travel activities in many of the markets where we operate," said James Liang, Executive Chairman. "In China, travel activities hit bottom in February, and have since been consistently on a recovery track. In recent weeks, the recovery in high-end hotel meaningfully outpaced other segments, thanks to our timely product innovation for the COVID-19 new normality. Travel is human nature and we have full confidence that the industry will return and reach new high as the pandemic recedes."

Gross margin was 74% for the first quarter of 2020, which decreased from 79% for the same period in 2019 and the previous quarter.

Sales and marketing expenses for the first quarter decreased by 38% to RMB 1.4 billion (USD 195 million) from the same period in 2019 and decreased by 44% from the previous quarter. Sales and marketing expenses for the first quarter of 2020 accounted for 29% of the net revenue for the same period.

Net loss attributable to Trip.com Group's shareholders for the first quarter of 2020 was RMB 5.4 billion (USD 754 million), compared to net income attributable to Trip.com Group's shareholders of RMB 4.6 billion in the same period in 2019 and RMB 2.0 billion in the previous quarter.

As of March 31, 2020, the balance of cash and cash equivalents, restricted cash, short-term investment, held to maturity time deposit and financial products was RMB 68.2 billion (USD 9.6 billion). Trip.com Group believes its cash reserve, the aggregated cash flow from operations and financing sources will be sufficient to meet the anticipated cash needs amid COVID-19.

The company secured a facility agreement in April with a revolving loan of up to USD 1.0 billion and an incremental facility of up to USD 500 million. It made a USD 1.0 billion drawdown in May, 2020.

Business outlook

Due to continued negative impact of COVID-19, the company expects net revenue to decrease by 67% to 77% year-over-year for the second quarter of 2020.