Tongcheng Elong, a Chinese online travel company backed by both Tencent and Ctrip, applied on June 21 for listing on the Stock Exchange of Hong Kong.

According to the company's Application Proof file submitted to the Exchange:

Tongcheng Elong is the combined business resulting from the merger of Tongcheng and eLong, which was completed in March 2018. Tongcheng was founded in 2004 and eLong was founded in 1999.

As of December 31, 2017, the online platforms of Tongcheng and eLong offered over 6,400 domestic routes and over 594,000 international routes operated by 306 domestic and international airlines, over 1 million hotels and alternative accommodation options, approximately 450,000 bus routes, and over 300 voyage routes.

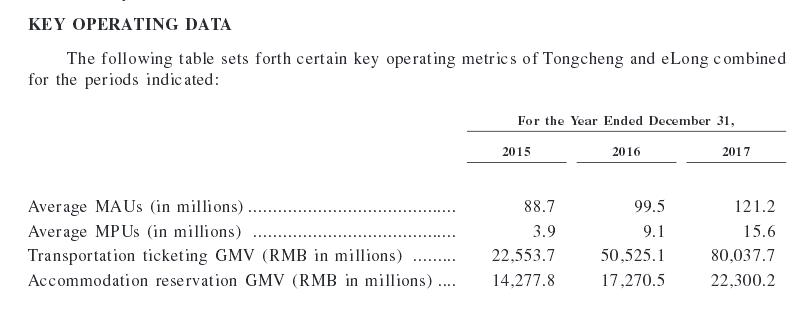

The average MAUs of Tongcheng and eLong combined increased from 88.7 million in 2015 to 121.2 million in 2017, representing a CAGR of 16.9%.

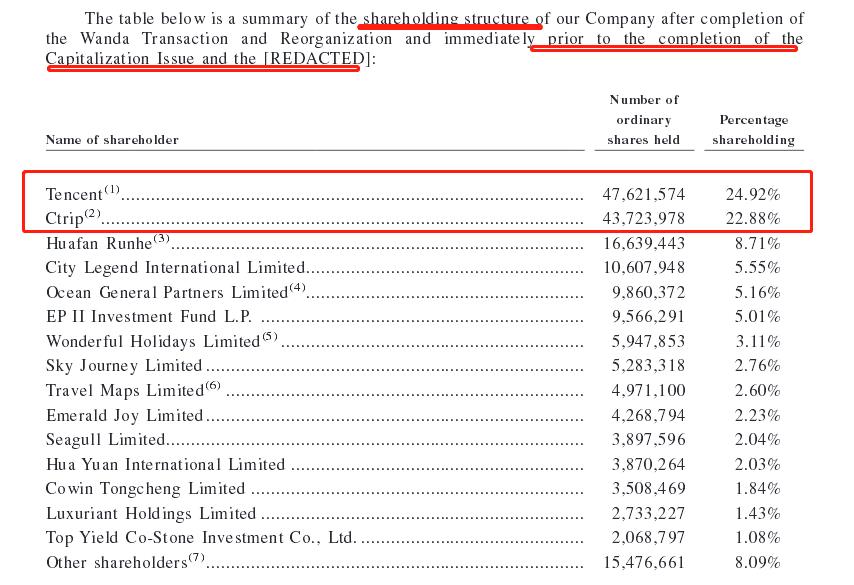

Shareholding structure prior to IPO application

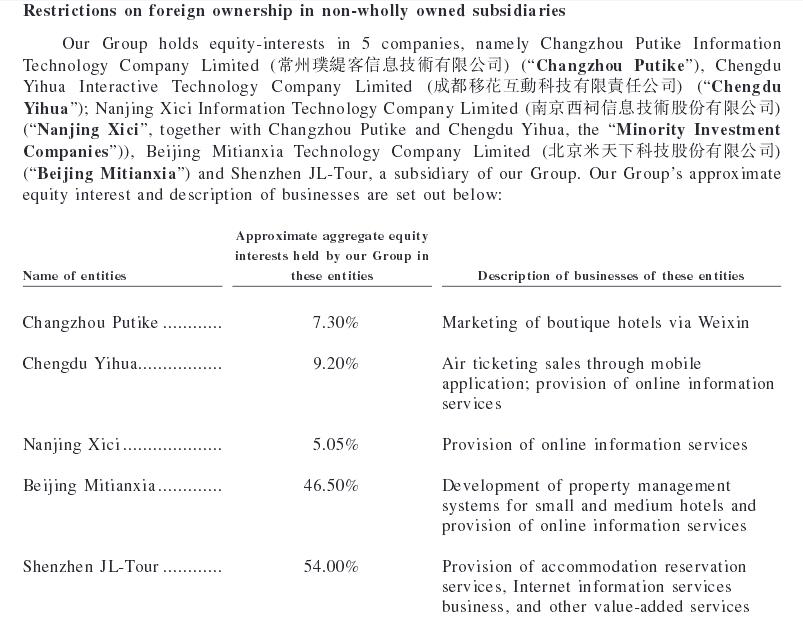

Subsidiaries ownership

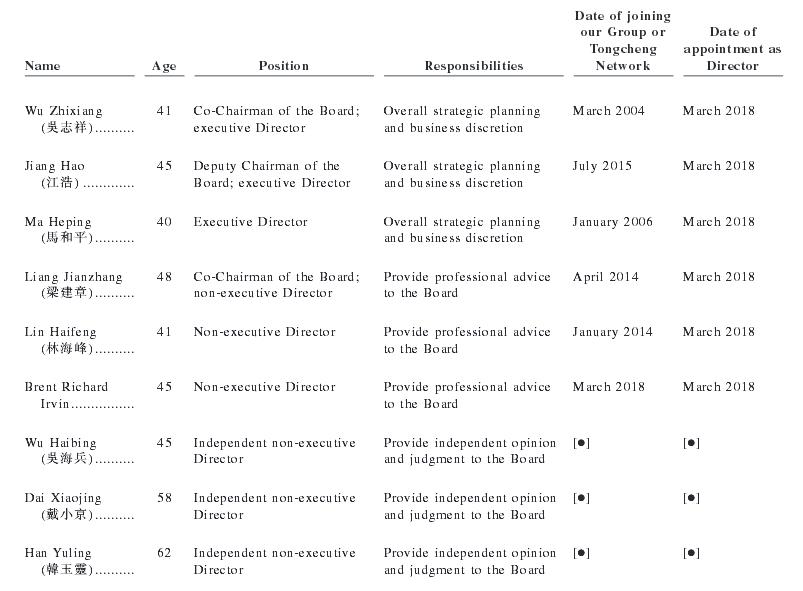

Board of directors

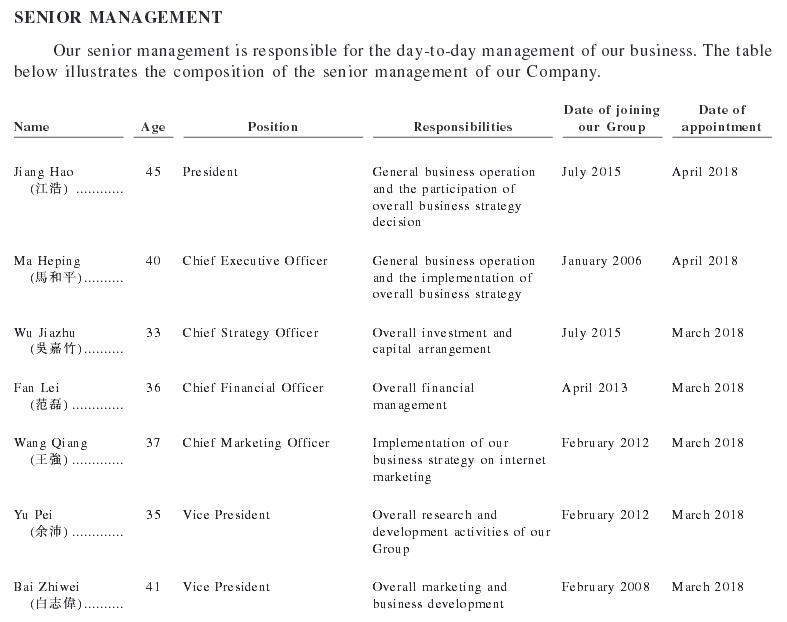

Senior management

Tongcheng Elong delivers travel product offerings primarily through its Tencent-based platforms (WeChat and QQ), as well as its own mobile apps and websites.

In 2017, the average MAUs of Tencent-based platforms of Tongcheng and eLong combined were 79.6 million; the average MAUs of Tongcheng and eLong’s mobile apps and WAP pages were 27.9 million; and the average MAUs of Tongcheng and eLong’s websites was 13.7 million.