Tuniu announced its unaudited financial results for the third quarter ended September 30, 2017.

Highlights for the Third Quarter of 2017

* Net revenues was RMB 806.1 million (USD 121.2 million), an increase of 53.5% year-over-year when compared with Non-GAAP net revenues in the third quarter of 2016.

* Gross profit was RMB 440.9 million (USD 66.3 million), an increase of 73.5% year-over-year when compared with Non-GAAP gross profit in the third quarter of 2016.

* Non-GAAP net income in the third quarter of 2017 was RMB 39.7 million (USD 6.0 million), compared with a Non-GAAP net loss of RMB 496.7 million in the third quarter of 2016.

* Net loss was RMB 27.0 million (USD 4.1 million) in the third quarter of 2017, compared to a net loss of RMB 559.0 million in the third quarter of 2016.

Mr. Donald Dunde Yu, Tuniu´s co-founder, Chairman and Chief Executive Officer, said, "We are delighted to report solid results for the third quarter of 2017. Net revenues increased by 53.5% year-over-year during the third quarter while gross profit increased by 73.5% year-over-year. Tuniu continues to make exceptional progress with our core strategies of expanding our offline sales presence, implementing our own local tour operators and improving our technology infrastructure. These strategies are developing into our core competitive advantage, differentiating Tuniu from its industry peers as well as strengthening our leading position in China´s attractive online leisure travel industry."

Ms. Maria Yi Xin, Tuniu´s Chief Financial Officer, said, "The strategies that we have implemented in the past years are starting to benefit our operations and financials. As a result, for the first time since our listing, we have reached non-GAAP profitability, a positive step towards achieving long-term profitability. As we continue to execute our core strategies and optimize our operations, Tuniu will expand while maximizing value for our customers and shareholders."

Third Quarter 2017 Results

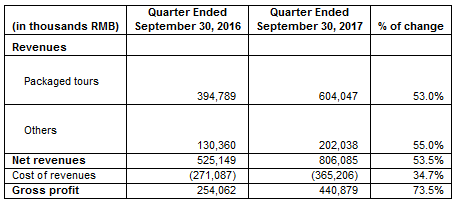

Net revenues were RMB 806.1 million (USD 121.2 million) in the third quarter of 2017, representing a year-over-year increase of 53.5%, compared with Non-GAAP net revenues, from the corresponding period in 2016.

Revenues from packaged tours, which are mainly recognized on a net basis, were RMB 604.0 million (USD 90.8 million) in the third quarter of 2017, representing a year-over-year increase of 53.0%, compared with Non-GAAP revenues from packaged tours, from the corresponding period in 2016. The increase was primarily due to the growth of organized tours and self-guided tours.

Other revenues were RMB 202.0 million (USD 30.4 million) in the third quarter of 2017, representing a year-over-year increase of 55.0%, compared with Non-GAAP other revenues, from the corresponding period in 2016. The increase was due to a rise in revenues generated from financial services and commission fees received from certain travel-related products.

Gross profit was RMB 440.9 million (USD 66.3 million) in the third quarter of 2017, representing a year-over-year increase of 73.5%, compared with Non-GAAP gross profit, from the corresponding period in 2016. The increase in gross profit and gross margin was primarily due to improved economies of scale, increased operational efficiency and optimized supply chain management.

Net loss was RMB 27.0 million (USD 4.1 million) in the third quarter of 2017, compared to a net loss of RMB 559.0 million in the third quarter of 2016. Non-GAAP net income, which excluded share-based compensation expenses and amortization of acquired intangible assets, was RMB 39.7 million (USD 6.0 million) in the third quarter of 2017.

Net loss attributable to ordinary shareholders was RMB 29.3 million (USD 4.4 million) in the third quarter of 2017, compared to a net loss attributable to ordinary shareholders of RMB 556.2 million in the third quarter of 2016. Non-GAAP net income attributable to ordinary shareholders, which excluded share-based compensation expenses and amortization of acquired intangible assets, was RMB 37.4 million (USD 5.6 million) in the third quarter of 2017.

As of September 30, 2017, the Company had cash and cash equivalents, restricted cash and short-term investments of RMB 4.4 billion (USD 658.7 million).

For the fourth quarter of 2017, Tuniu expects to generate RMB 450.4 million to RMB 466.5 million of net revenues, which represents 40% to 45% growth year-over-year compared with Non-GAAP net revenues in the corresponding period in 2016. This forecast reflects Tuniu´s current and preliminary view on the industry and its operations, which is subject to change.

Read original report