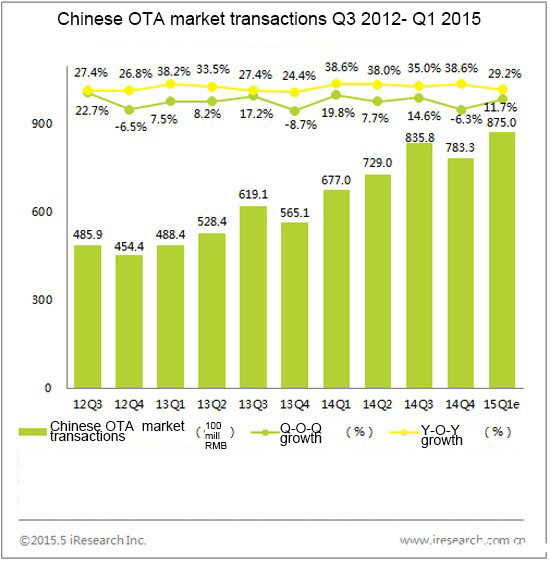

China’s OTA market recorded RMB87.5 billion (approx: US$14.1 billion) in transactions during the first quarter of 2015 an increase q-o-q of 11.7% and 29.2% y-o-y.

OTA market over RMB80 billion in Q1 2015

According to data consultants iResearch, China’s OTA market maintained stable growth in Q1 2015 for the following reasons:

1. This year’s Spring Festival holiday was especially good, with record outbound tourism numbers and all major OTAs boosting subsidies and promotions to battle for market shares which greatly stimulated tourism expenditure.

2. Mobile apps helped promote the OTA market and greater integration of diverse customer needs. The marketization of OTA business models spurred innovation and drove the OTA market ahead.

Revenue also rose y-o-y by 26.4% to a total of RMB4.01 billion (approx: US$648 million) in the same period, according to the iResearch data.

The air ticket, hotel and resort segments in the OTA market saw the most dramatic changes.

1. China’s carriers continued their reduction of ticket agent commissions which has a different effect on agents on different levels. The OTA market recorded a slowdown of growth in Q1, at 19.2%, compared to 21.6% in the previous quarter.

2. Hotels' direct sales ratio increased, putting pressure on OTA bookings, a core source of their profit. Demand for luxury accommodation was also under pressure but profits from boutique and select hotels, guesthouses and inns rose. Overall the hotel industry showed stable growth.

3. A price war over admission for attractions spurred growth for the daytrip segment and outbound tourism shot up in popularity. Generally, the resorts segment enjoyed stable growth at a rate of 24.1% y-o-y.

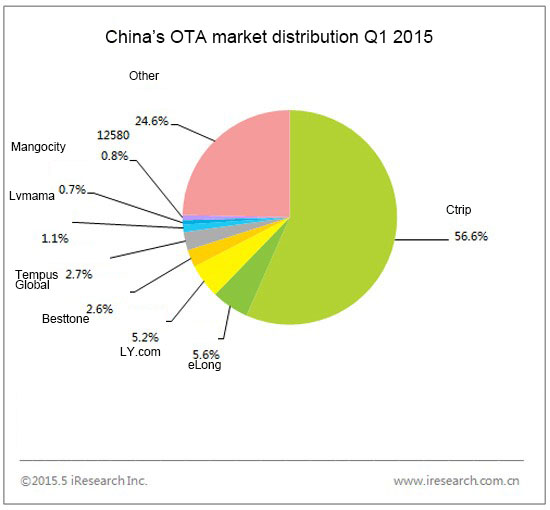

OTA market fragmentation and competition

China’s OTA market was more fragmented in Q1 2015. The ratio of income from major OTAs like Ctrip, eLong. LY.com, Travelling Bestone, Tempus Global, Mango City.com and 12580 dropped as the income share of minor OTAs advanced.

Major OTAs greatly stepped up subsidies to maintain their market shares.

Ctrip made major advances in its platform distribution for tickets, hotels and resorts and opened up its platform. Ctrip also promoted the development of resorts via domestic independent winery trips and acquired LCC platform Travelfusion to facilitate its overseas distribution.

2. eLong is continuing to focus on accommodation operations which includes hotels, apartments, inns and guesthouses. It is applying the low-cost carrier ticketing model to different operations in the industry, varying services to meet different customer levels and user needs.

3.LY.com set up an international attractions department and entered the outbound independent travel market in Q1 2015. Following the attractions price war in 2014, it started a price war in the resorts segment and significantly raised its market share in 2015.

(Translation by David)