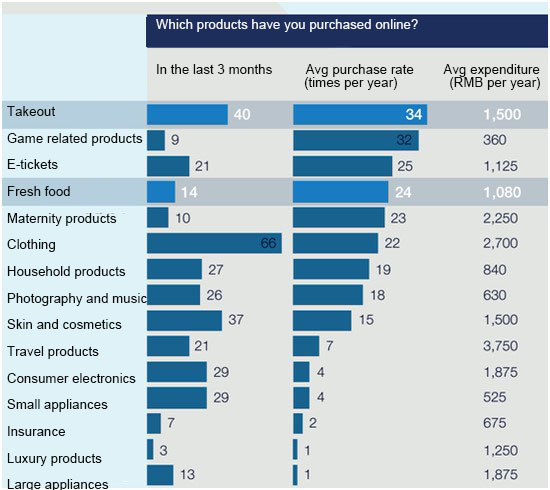

Chinese consumers spend the most on travel products when shopping online, forking out an average of RMB3,750 per year, according to report by McKinsey & Co.

McKinsey surveyed more than 6,000 Chinese internet users representing a pool of 630 million users in all of China, ranging from major cities to forth-tier townships.

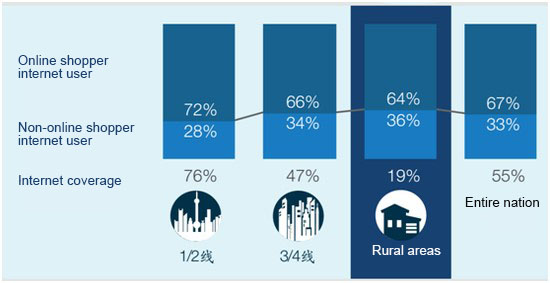

Covering also data from rural areas, the survey finds that although the internet coverage in smaller cities is less extensive, internet users in those cities are just as active in online shopping as their urban counterparts.

The survey analyzes six forms of digital activity – wireless communication and mobile computing, social networking like Wechat and Weibo, online games, online movies, e-commerce, and O2O.

The survey has identified the following trends for China’s online usage.

Social media and e-commerce on the rise.

China is one of the most socially active countries in the online world and Chinese netizens spend an average of 78 minutes a day per person on social media compared with 67 minutes for Americans. Referrals contributed to 50% of new interactions among Chinese users, compared with 40% for Americans. These trends are showing signs of gaining momentum.

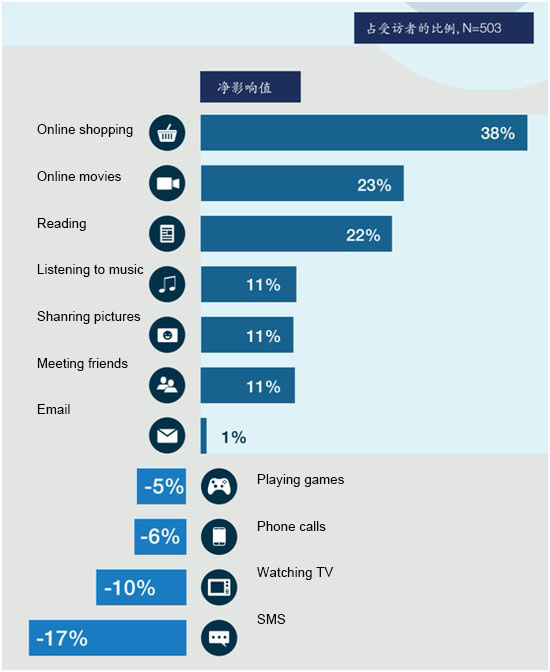

Model 1: Time spent on different activities by social networks users

The survey also shows that social media is stimulating online shopping and the time spent on online shopping, watching films and reading news and articles is increasing significantly.

Chinese e-commerce businesses are also taking their direct sales models to popular mobile platforms through semi-private groups of 50 to 100 users on SNS app Wechat.

Popularity of online shopping turns stores to showrooms

Brick-and-mortar retail venues are increasing becoming “showrooms”, for digital savvy shoppers. In the case of digital products – about 16% are sold online, compared to only 1% five years ago. Below is data showing the O2O consumer behavior of shoppers in stores.

Model 2: Consumer’s shopping channel data

Higher inclination to use O2O shopping channels

O2O shopping is already used by 71% of all e-commerce consumers in China and 97% of these shoppers plan to increase O2O shopping in the next six months. A third of the respondents who have not used O2O services yet are willing to try it within the next six months. Below are the types of O2O services consumers are interested to try.

Model 3: Chinese consumer’s O2O data for 2014

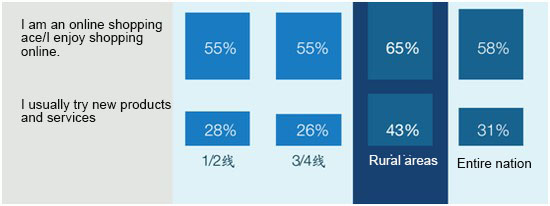

Rural internet users more keen on online shopping

While a high percentage of consumers in tier three and four cities shop online, at the rate of 68% and 60% respectively, consumers in rural areas are even more keen online shoppers having 25% more frequent online shoppers among users than in major cities.

Model 4: Online shopping trends of rural area netizens

Model 5: Internet coverage and distribution of online shoppers among users

Food most frequently purchased products

Demand for food products online has shot up and the category now has the highest purchase rate of all online products. Chinese users made 34 food purchases per year compared with 22 clothing purchases per year in 2014.

Model 6: Chinese consumer’s preferred product data

Food safety is the biggest concern among online shoppers, with 65% percent of respondents being“very concerned” about the issue compared with 36% and 26% in the USA and the UK respectively.(Translation by David)