ChinaTravelNews, Ritesh Gupta – Multi-brand Chinese hotel company H World Group’s hotels in operation as well as in the pipeline in the upper-midscale segment continue to swell.

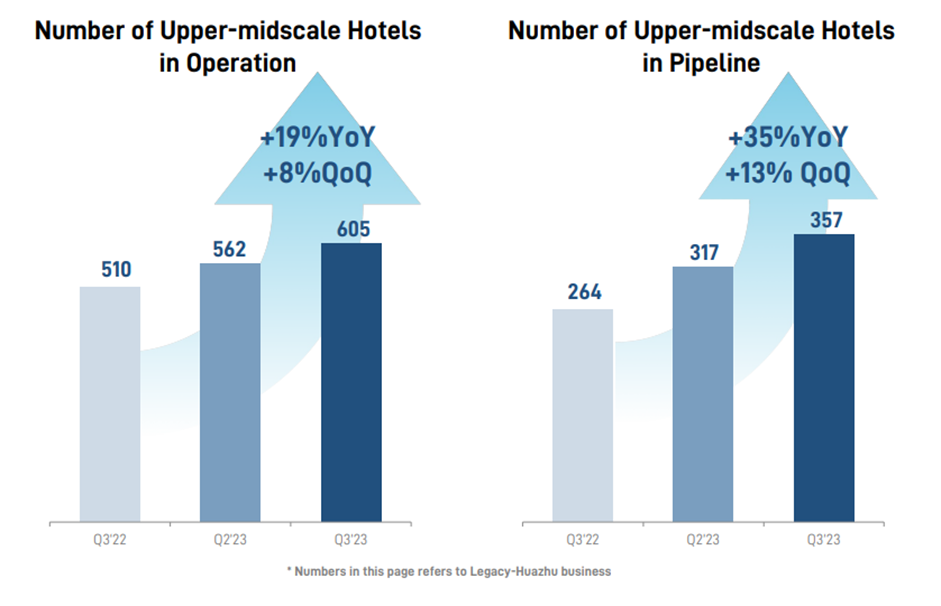

Providing an update regarding the same in its third quarter (Q3) financial results, the hotel company shared that in its Legacy-Huazhu business, the number of upper-midscale hotels in operation has risen by 19% on year-on-year basis, going up from 510 hotels at the end of Q3 last year to 605 by the end of the July-September period. H World had 562 hotels in operation at the end of June this year.

As for the total number of hotels in the pipeline, the figure stood at 357 at the end of Q3, rising by 35% from 264 hotels in comparison to 2022, and 317 hotels by June of this year.

The company highlighted that overall pre-opening costs maintained “at a low level” as H World continues to move towards the asset-light model.

Bigger plans for Crystal Orange and IntercityHotel brands

Brands in the upper-midscale category include Crystal Orange, CitiGO, Manxin, Madison, Mercure, Novotel, IntercityHotel and MAXX.

H World referred to the growing prowess of Crystal Orange and IntercityHotel brands over the past few months. Both brand have gained traction among franchisees.

For brand Crystal Orange Hotel featuring boutique design hotels, which is focused on offering a five-star quality experience at a four-star price, the company currently operates close to 175 properties, rising from 164 Crystal Orange Hotels in operation at the end of 2022. Also, the pipeline for this brand has grown tremendously, rising from 57 hotels under development at the end of December to current level of unopened 108 hotels. In fact, the pipeline has grown by 48 hotels in the last six months for this brand.

For IntercityHotel, a brand targeting business travelers and hotels that are usually located within walking distance of train stations or airports, the portfolio of unopened hotels has risen considerably, the plan has moved on aggressively. From 25 hotels in the pipeline, this number has risen to 53 in the last nine months. Out of these, 41 pipeline hotels of Intercity Hotel were in China.

Surpassing the revenue guidance

Revenue increased 53.6% year-over-year to RMB 6.3 billion (US$861 million) in Q3.

This financial performance, according to the company, surpassed the revenue guidance previously announced of a 43% to 47% increase compared to Q3 of 2022.

Revenue from the Legacy-Huazhu segment in Q3 increased 61.8% year-over-year (to RMB 5.1 billion), exceeding the revenue guidance previously announced of a 49% to 53% increase.

H World stated that Q3 revenue of Legacy-Huazhu increased significantly as compared to last year owing to strong travel demand, especially during the summer holiday; continued product upgrade; and market penetration and synergy through regional offices.

Jin Hui, CEO of H World mentioned that the hotel company continues to “outperform the China lodging industry, delivering robust operational results”.

The occupancy rate for all the Legacy-Huazhu hotels in operation was 85.9% for the July-September period (it was 76% in Q3 of 2022 and 81.8% in the previous quarter).

Blended RevPAR was RM B278 in Q3 of 2023, compared with RMB193 in the QQ3 of 2022, RMB 250 in the previous quarter.

Performance of DH portfolio

Legacy-DH business or DH revenue improved by 26.1% as compared to the same period last year, and remained on similar level as compared to the previous quarter.

The group stated that DH continues to drive operating efficiency and strategic growth. As of September 30, 2023, Legacy-DH had 129 hotels in operation, including 82 leased hotels, and 47 manachised and franchised hotels.

It added that despite Germany’s slow economic recovery post-Covid, DH’s portfolio continues to outperform the overall market. The third quarter’s year-on-year cost growth is in line with revenue growth despite inflationary pressure in Europe after excluding one-off adjustments (e.g. restructuring, etc).

The priority going forward is to control and reduce cost through business restructuring and leveraging on technology.