Tuniu has revealed latest details about its share ownership, recent investments as well as fund conditions in an audited annual report submitted to SEC on April 18.

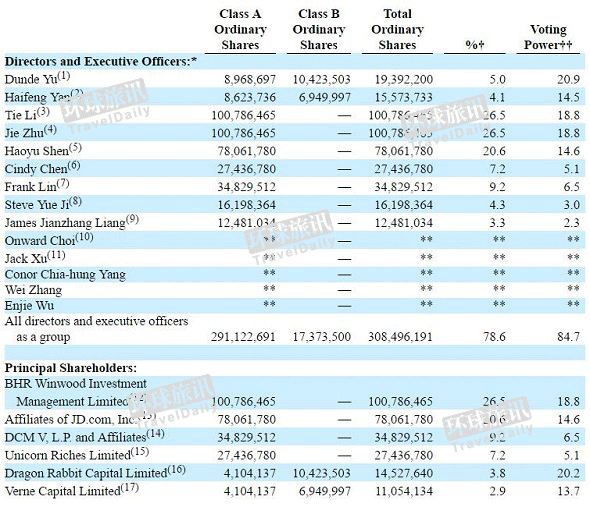

Share Ownership

As of March 31, 2017, beneficial ownership of the company:

CEO Donald Yu held a 5% economic interest and a 20.9% voting right in Tuniu while the company's president Haifeng Yan owned a 4.1% economic interest and a 14.5% voting right in the company.

Tuniu's largest stakeholder HNA Group controlled a 26.5% economic interest and a 18.8% voting right. The company's second largest shareholder JD.com's representative Mr. Haoyu Shen held a 20.6% economic interest and a 14.6% voting right in Tuniu.

Mr. James Jianzhang Liang, held a 3.3% economic interest and a 2.3% voting right in Tuniu, representing 12,481,034 Class A ordinary shares held by Ctrip.

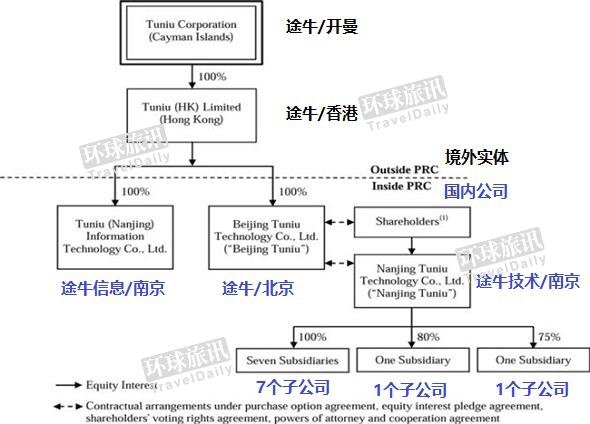

Tuniu's corporate structure

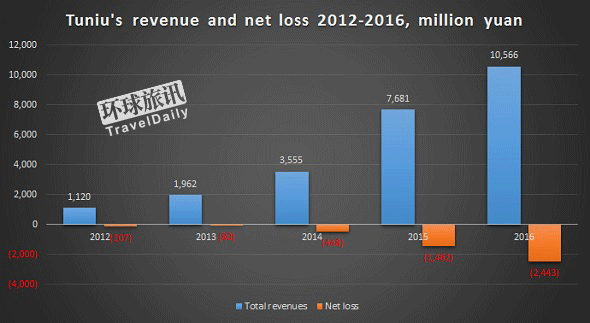

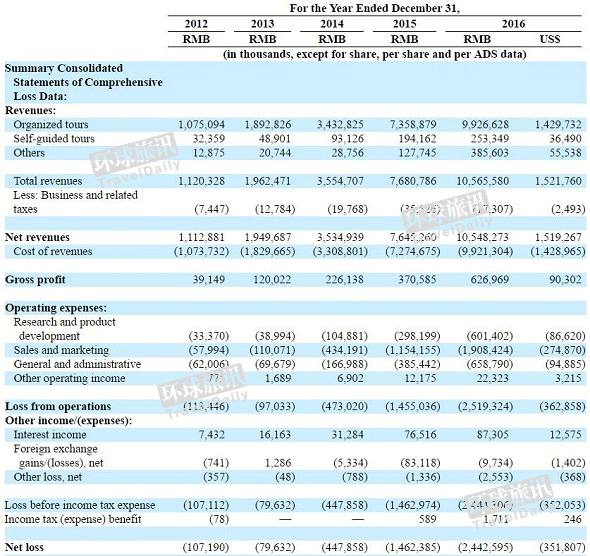

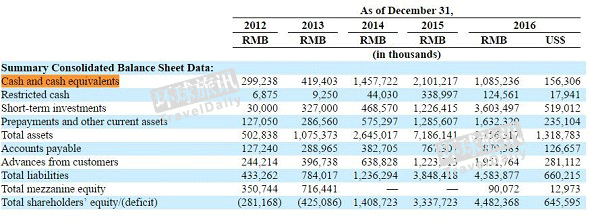

Core financial data

The company said that it has incurred net losses historically and will likely continue to incur losses in the future as we grow our business. A net loss of RMB 447.9 million, RMB 1,462.4 million and RMB 2,442.6 million (USD 351.8 million) were recorded in 2014, 2015 and 2016, respectively.

Tuniu atributed its historical net losses partially to spending associated with expanding business operations, including expenses related to regional expansion, branding and advertising campaigns, mobile related initiatives and expenses related to technology, product development and administrative personnel such as share-based compensation.

The company expects that it will continue to incur significant expenses to further grow our business, which will affect our profitability and cash flow from operations in the future.

As of the end of 2016, Tuniu has cash and cash equivalents of RMB 1.085 billion (USD 156 million), splashing out around RMB 1 billion in the year.

The company said that its current cash and cash equivalents and anticipated cash flow from operations will be sufficient to meet anticipated cash needs for at least the next 12 months, but that it may require additional cash resources due to changed business conditions or other future developments, including any marketing initiatives or investments we may decide to pursue.

IPO and private placements

Tuniu completed initial public offering and listed its ADSs on the NASDAQ under the symbol “TOUR” in May 2014. At the time of our initial public offering, we also entered into a concurrent private placement with three investors:

In December 2014, it entered into a share subscription agreement with Unicorn Riches Limited, a special purpose vehicle of Hony Capital, JD.com E-commerce (Investment) Hong Kong Corporation Limited, a special purpose vehicle of JD.com, Inc. (Nasdaq: JD), Ctrip Investment Holding Ltd., a subsidiary of Ctrip.com International and the respective personal holding companies of Tuniu’s chief executive officer and chief operating officer, pursuant to which we sold a total of 36,812,868 newly issued Class A ordinary shares for USD 148 million.

In May 2015, it entered into a share subscription agreement with each of Fabulous Jade Global Limited, a subsidiary of JD.com, Inc., Unicorn Riches Limited, a special purpose vehicle of Hony Capital, DCM Ventures China Turbo Fund, L.P. and DCM Ventures China Turbo Affiliates Fund, L.P., both affiliates of DCM V, L.P., Ctrip Investment Holding Ltd., a subsidiary of Ctrip.com International, Ltd., Esta Investments Pte Ltd, an affiliate of Temasek Holdings and Sequoia Capital 2010 CV Holdco, Ltd, an affiliate of Sequoia Capital, pursuant to which we sold a total of 93,750,000 newly issued Class A ordinary shares for USD 500 million.

In November 2015, we entered into a share subscription agreement with HNA Tourism Group, or HNA Tourism, pursuant to which an affiliate of HNA Tourism purchased 90,909,091 newly issued Class A ordinary shares from us for USD 500 million in January 2016.

Acquisitions of offline travel agencies

During the year ended December 31, 2015, we acquired 100%, 100%, 75% and 80% of equity interests of four offline travel agencies, respectively. We gained access to the expanding Taiwan tourism market and improved the capability in the direct procurement of products with these acquisitions. The total purchase price was RMB 115.5 million, which included cash consideration of RMB 100.2 million and RMB 15.3 million, the fair value of contingent cash consideration to be made based on the achievement of certain revenue and profit target over the next three to four years.

During the year ended December 31, 2016, we acquired 100% of equity interests of one offline travel agency, to further expand our oversea tourism market and promote our destination service. The total purchase price was RMB 28.1 million (USD 4.0 million), which included cash consideration of RMB 16.5 million (USD 2.4 million) and RMB 11.6 million (USD 1.6 million), the fair value of contingent cash consideration to be made based on the achievement of certain revenue and profit target over the next four years.