LANGLEY, U.K., Feb. 18, 2016 /PRNewswire/ -- Travelport Worldwide Limited (NYSE: TVPT) announces its financial results for the fourth quarter and full year ended December 31, 2015.

Key Points (for full year 2015 unless stated otherwise)

1. Fourth quarter net revenue up 8%, Adjusted EBITDA up 18% and Adjusted Income per Share (diluted) up $0.23

2. Beyond Air revenue up 16% to $492 million; now 23% of Travel Commerce Platform revenue (2014: 21%)

3. Hospitality segment attachment up 11% to 47 per 100 airline tickets issued

4. eNett revenue up 36% to $92 million.

Gordon Wilson, President and CEO of Travelport, commented:

"In 2015, we saw strong underlying progress across the entire business, resulting in financial performance ahead of guidance and with real growth momentum carrying forward to 2016. Our performance in Air was especially pleasing as our merchandising innovations continue to facilitate commercial success. In Beyond Air, which grew by 21% in Q4, we expanded our content leadership position in hospitality and achieved a record attachment rate of 50% this past quarter. Our fast-growing payments business, eNett, continues its upward trajectory and has seen considerable momentum into 2016 with the business achieving a record month of revenue in January. We are also seeing progress in other parts of our digital asset portfolio that includes MTT, our recently acquired mobile commerce business, as well as Locomote and Hotelzon. With these innovations, we are uniquely positioned to capture the new opportunities in the digital travel economy, and I re-affirm the positive outlook for Travelport as expressed in our guidance for 2016."

Discussion of Results

Fourth Quarter 2015

Net Revenue

Net revenue increased by $39 million, or 8%, to $535 million primarily due to growth in Travel Commerce Platform revenue of $33 million, or 7%. RevPas increased 15% to $6.63, driving a $51 million increase in Travel Commerce Platform revenue, which was offset by lower volumes. International Reported Segments increased 3%, driving $11 million of the increase. Overall, total Reported Segments decreased 7% to 76 million.

Within Travel Commerce Platform revenue, Air increased by $10 million, or 3%, and Beyond Air by $23 million, or 21%.

Adjusted EBITDA

Adjusted EBITDA increased by $20 million, or 18%, to $130 million.

Full Year 2015

Net Revenue

Net revenue increased by $73 million, or 3%, to $2,221 million primarily due to growth in Travel Commerce Platform revenue of $64 million, or 3%. RevPas increased 8% to $6.13, driving a $118 million increase in Travel Commerce Platform revenue. International Reported Segments increased 1%, driving $15 million of the increase, offset by an 11% decrease in United States Reported Segments due to the impact of our contract with Orbitz Worldwide renegotiated in 2014. Overall, total Reported Segments decreased 4% to 342 million.

Within Travel Commerce Platform revenue, Air decreased by $4 million, and Beyond Air increased by $68 million, or 16%.

Adjusted EBITDA

Adjusted EBITDA decreased by $5 million, or 1%, to $535 million.

Adjusted Net Income (Loss)

Adjusted Net Income (Loss) improved by $29 million in the fourth quarter and by $133 million for the full year.

Business Update

1. Strong performance across key international regions and continued momentum in corporate and leisure travel

Travelport's Travel Commerce platform revenue grew 7% in Q4. Revenue from International regions grew by 14% in Q4, more than offsetting the anticipated decline (7%) in revenue from the United States. Travelport continued its strong progress in Europe across both Air and Beyond Air, with revenue growth of 15% in Q4. Progress in Asia Pacific also continued with Q4 revenue growth of 14%. Revenue from Latin America and Canada grew by 18% in Q4.We are particularly pleased that in India, we grew at almost twice the rate of the Indian GDS air market. Moreover in South Korea, our share of business increased in all of the major online travel agencies (OTAs) in the country. In Russia, we signed new and extended agreements with several leading OTAs and travel management companies (TMCs).

2. Continued Air content and merchandising leadership

During the period, Travelport signed a new long-term distribution agreement with Frontier Airlines. Furthermore, Tigerair Taiwan signed their first ever global content and merchandising agreement with Travelport. Our airline merchandising solutions continue to differentiate us from our peers in the indirect distribution channel.

3. Continued momentum in Beyond Air with reinforced leadership positions in hospitality, payments and mobile commerce

Revenue from Beyond Air grew by 21% in Q4.

Beyond Air revenue, excluding eNett, grew by 16% to $105 million in Q4:

Hospitality segments booked per 100 airline tickets issued via our Platform reaching 50 for the first time in our history in Q4 (from 46 in Q4 2014). Car rental bookings continued to see good growth in Q4, with car rental days sold up 6% principally driven by our large OTA partners.

eNett's net revenue for Q4 was $26 million, representing growth of 43% on a reported basis (Q4 2014: $18 million).

During the period, eNett signed an exclusive global agreement with AirAsia enabling travel agencies to purchase AirAsia flights at a lower price using eNett's Virtual Account Numbers (VANs).

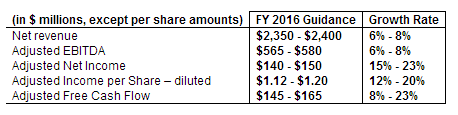

Outlook and Financial Guidance

Read original article