ChinaTravelNews, Ritesh Gupta - CAR Inc. has highlighted that even as China’s macroeconomy continues to undergo structural reforms, the auto mobility provider’s clear business model and sharp execution capabilities have enabled the organization to post solid Q1 results.

Emerging technologies around auto and Internet are driving changes in the auto ecosystem. The emergence of the new mobility service options such as ride sharing and car chauffeured services may dilute the needs for car rental services going forward. But CAR Inc. has continuously improvised, and managed to efficiently run growth initiatives in short-term rental self-drive business, increasing benefits from the collaboration with UCAR, and devised better disposal channels for used cars.

Short-term rental business – core focus

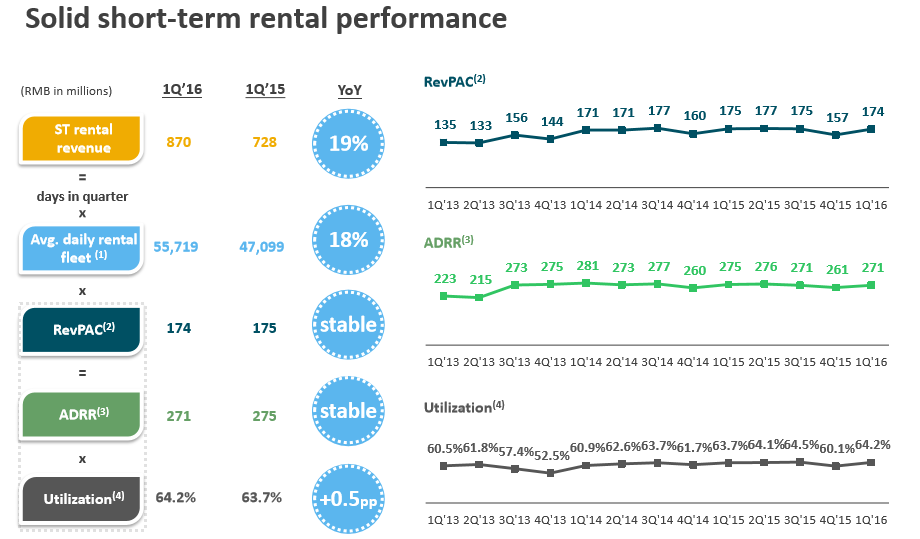

CAR Inc. has managed to sustain its cost advantage and leverage pricing power in the short-term rental business.

From operations’ perspective, this is being reflected in higher utilization via efficient demand forecasting and fleet supply management.

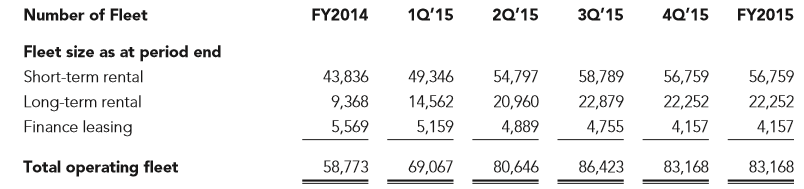

The short-term rental fleet was 43,836 at the end of 2014. It rose to 56,759 by the end of last year, and the total size of operating fleet was 83,168.

The growing short-term rental fleet size has boosted revenue generation, too. Short-term rental revenue increased 35% to RMB3,103.5 million last year.

The short-term rental fleet was 56,141 vehicles at the end of Q1. The short-term rental revenue during the first quarter increased 19% to RMB869.6 million. RevPAC remained solid at RMB174. Short-term rental revenue consisted of revenue from both self-drive and the daily sharing fleet with UCAR under short-term rental contract.

The fleet utilization rate further increased to 64.2%, from 63.7 when compared for the same period last year.

During the first quarter of 2016, new customers contributed 39% of total transactions. Going forward the plan is to focus on new vehicle model trial-drive and promotions, and also work out exclusive channels for new customer acquisition.

The group has also planned other growth initiatives in several areas for short-term rentals – organizational enhancement (new incentive programs for frontend office, flatter organization, talent development programs etc.) and customer experience upgrade (rental fleet upgrade and optimization, consumer-friendly value-added-services and gradual path to “car rental on demand”).

CAR Inc. is also looking at co-marketing and cross-selling with UCAR.

In fact, other than short-term rental business, UCAR’s performance, too, was highlighted.

UCAR focuses on the mid-to-high-end sector and adopts an asset-light yet operation-heavy B2C model. A major strength is to meet demand for value-for-money chauffeured services in China.

CAR Inc. asserts that UCAR’s unique B2C model offers major benefits, and these are about regulatory compliance, premium pricing through better customer experience, and fixed cost structure with limited influence from competitions. Overall, the collaboration with UCAR has allowed CAR Inc. to realize better synergies through fleet sharing. Last year the fleet utilization rate further increased to 63%, with a deliberate balance to secure more license plates.

For the year ended 31 December 2015, revenue contribution from the UCAR collaboration was RMB1.6 billion.

Used car B2C platform

Other than targeting car sharing in higher-tier cities, CAR Inc. has also been preparing to capitalize on underserved vacancy in the used car market in lower-tier cities. This relatively new set up or the B2C model has the capacity to cut intermediate costs, offer product assurance and enables brand premiums. A major drive behind this move, which is about managing the full cycle of the rental business, is deep expertise in used car disposal over the past three years. Used cars form a considerable part of the company’s assets and the business requires the team to constantly replenish the fleet. The team disposed of 9,284 used vehicles at the end of last year, compared with 15,483 in 2014.

The cost of sales of used vehicles represents the net book value of the sold rental vehicles from the company’s fleet.

As for how the company is delivering well-round results via a thorough understanding of the business, CAR Inc. stated that it disposed of 5,404 used vehicles in Q1 and the cost to sales ratio was 98.0%. So the company is managing to sell cars close to their estimated residual values.

Also, after aligning with UCAR, CAR Inc managed to prolong the holding period for certain vehicle models by continuing operation in UCAR fleet. Also, over the last 12 months, the company has stepped up the holding period of core models to around three years to combat residual risk. As a result of the new initiative of used car B2C platform, the number of retired vehicles awaiting for sale increased to 6,837 at the end of last year.

Referring to risk mitigants, the company referred to following developments:

1. The company continues to build on its used car B2C pilot program; concluding with 14 stores in tier-3 cities, and is further ramping up. The stores sold an average of 30 used cars each in December. Average monthly operating cost per store is ~RMB300,000.

2. B2C auto e-commerce platform: In April, together with the launch of the strategic partnership with Alibaba, UCAR is preparing to launch a B2C automotive e-commerce platform with a broad national offline sales and service network.

3. In March, the company sold 2,995 vehicles to Maimaiche (Fujian) Used Car Co (Maimaiche Fujian). In April, UCAR acquired a 70% stake in the parent company of Maimaiche Fujian. Vehicles sold to Maimaiche Fujian were at prices in line with prevailing market transaction price on B2B platforms, shared the company.

4. Better manage seasonality through fleet sharing

CAR Inc. has had a hectic start to the year, witnessing a series of shareholding and organizational changes.

Charles Zhengyao Lu, chairman and former CEO, and Jenny Zhiya Qian, former COO, resigned to take up CEO and COO roles in UCAR, respectively. Yifan Song, a founding member and executive vice-president of the company, and Wilson Wei Li, the CFO of the company, were appointed as the CEO and COO of the company respectively.

These changes have been executed in order to capitalize on emerging growth opportunities, to optimize shareholder value and generate synergies.